Retirement tax calculator 2021

Enter your filing status income deductions and credits and we will estimate your total taxes. Current contributions mean you will retire with R2923538 at age 65.

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Based on your projected tax withholding for the year we can also estimate.

. We have the SARS tax rates tables. Or individual retirement account is a tax. The Income Tax Calculator estimates the refund or potential.

In 2022 it is 12950 for single taxpayers and 25900 for married taxpayers filing jointly slightly increased from 2021 12550 and 25100. The federal estate tax exemption has increased over the years to 117 million in 2021 and 1206 million in 2022. Current retirement annuity pension provident per month.

Between 25000 and 34000 you may have to pay income tax on. Required minimum distributions are waived in 2020. Your average tax rate is 1198 and your marginal.

You will pay tax on only 85 percent of your Social Security benefits based on Internal Revenue Service IRS rules. Of the 12 states and Washington DC. If you make 70000 a year living in the region of California USA you will be taxed 15111.

The easiest way to calculate your tax bracket in retirement is to look at last years tax return. Use these free retirement calculators to determine how much to save for retirement project savings income 401K Roth IRA and more. Federal Tax Withholding Calculator.

Use Forbes Advisors retirement calculator to help you understand where you are on the road to a well-funded secure retirement. Least 15 of your. For 2020 look at line 10 of your Form 1040 to find your taxable income.

That have their own estate tax. Figure your monthly Federal income tax withholding. Are not subject to the.

COVID-19 Relief Available for Retirement Plans and IRAs. Distributions related to coronavirus. Federal Employees Group Life Insurance FEGLI calculator.

In general investments are used as a method to grow wealth but people who have maxed out their tax. Use our fund benefit calculator to work out the tax payable on lump sum payments from Pension funds Provident funds andor Retirement Annuity funds. California Income Tax Calculator 2021.

Retirement tax calculator 2021 Jumat 09 September 2022 Automated Investing With Tax-Smart Withdrawals. Our Retirement Calculator can help by considering inflation in several calculations. 2021-2022 Tax Brackets.

Total income per month.

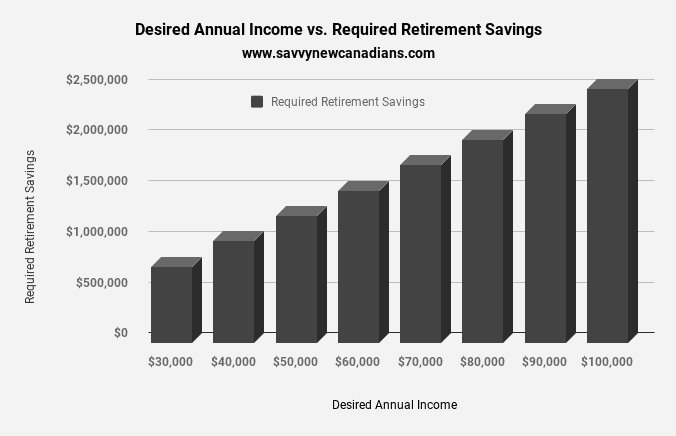

How Much Do I Need To Retire In Canada 5 Simple Steps

Tax Calculator Estimate Your Income Tax For 2022 Free

2021 2022 Income Tax Calculator Canada Wowa Ca

How Are Dividends Taxed Overview 2021 Tax Rates Examples

How Much Money Do I Need To Retire In Canada In 2022

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

California Paycheck Calculator Smartasset

Tax Withholding For Pensions And Social Security Sensible Money

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

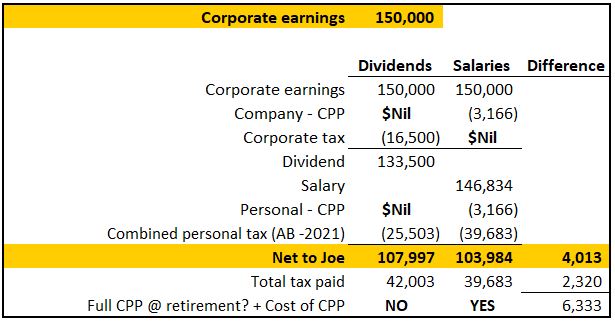

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

Tax Withholding For Pensions And Social Security Sensible Money

Canada Capital Gains Tax Calculator 2022

Best Retirement Planning Tools For 2022 Some Are Even Free

Ontario Income Tax Calculator Wowa Ca

Personal Income Tax Brackets Ontario 2021 Md Tax

Marginal Tax Vs Average Tax Understanding Canadian Tax Brackets